As a financial guide for your business’ future, a budget creates certain expectations about your company’s performance. Budget forecasting aims to determine the ideal outcome of the budget, assuming that everything proceeds as planned. It relies on the budget’s data, which relies on financial forecasting data. A budget represents your business’ cash flow, financial positions, and future goals and expectations for a set fiscal period.

Historical forecasting

Especially with complex, multivariable analysis, you can run multiple permutations and discover opportunities and challenges you may not have known otherwise. Creating financial forecasts is more complex than it used to be, thanks in part to the availability of so much real-time data and better tools. For example, fraud detection, buying patterns, machine learning, customer segmentation, real-time stock market information, and other details add complexity as they open up more possibilities. Financial forecasts are a core piece of business planning, operations, budgeting, and funding.

Managing uncertainty by planning ahead

It also allows you to forecast across any time horizon — whether it be daily, monthly, quarterly, or long-term. Top-down forecasting is a financial forecasting model where a company starts by analyzing broader market data and ultimately whittles down company-specific financial forecasting examples revenue projections from there. Financial forecasting estimates important financial metrics such as sales, income, and future revenue. These metrics are crucial for finance-related operations such as budgeting and financial planning as a whole.

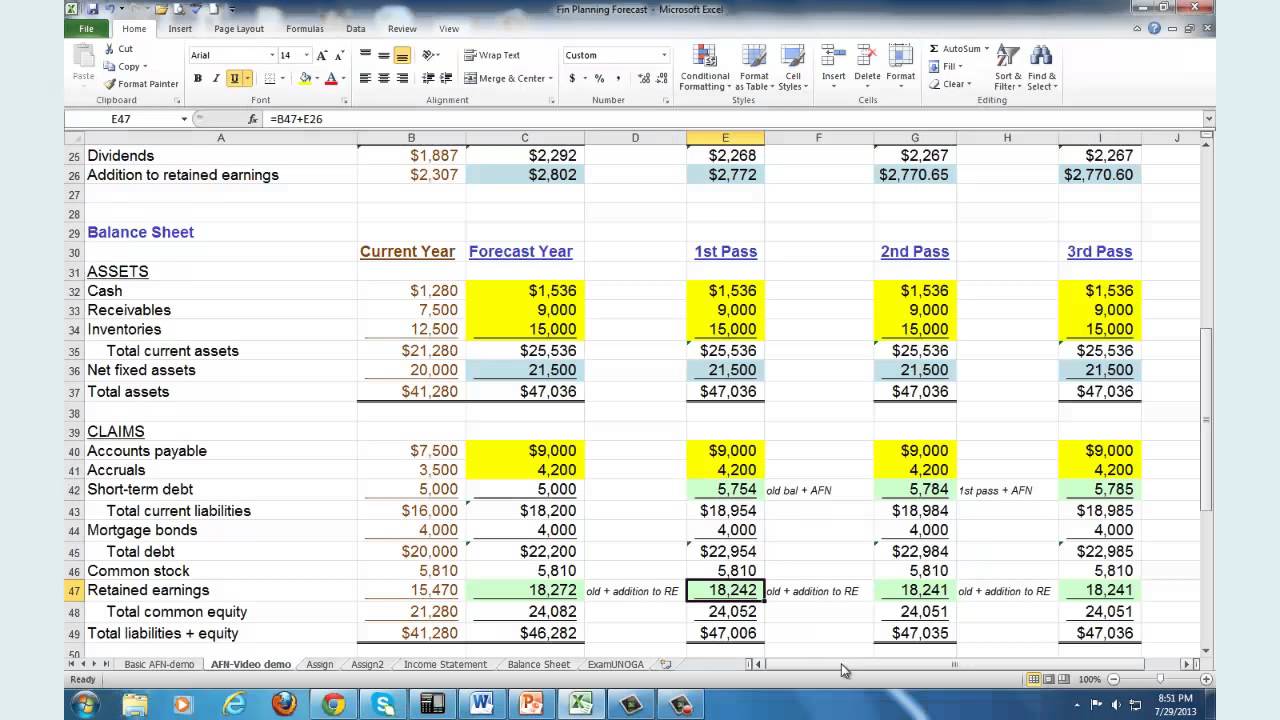

Financial Statement Modeling

It includes analyzing the business’s past performance and thoroughly studying current trends. The use of financial forecasting techniques helps businesses find direction and clearly lays out their goals based on their stage of growth. It also helps them find problem areas where optimization could result in more business and profits. At a macro level, it also makes it more attractive for investors to invest in a company with a high level of clarity. Some of the other resources listed here are multifaceted accounting solutions that happen to cover financial forecasting — not PlanGuru. Sage Intacct is a multifaceted accounting and financial planning software with an accessible interface and a suite of features that can streamline your financial forecasting time by over 50%.

Econometric models are particularly valuable for long-term planning and policymaking. Financial forecasting informs internal decisions, empowering teams to set realistic performance goals. It also highlights any financing requirements, such as seeking loans for a capital project, and is relied on by banks while making lending decisions. Below, we elaborate on what is financial forecasting, and why it is important for enterprises to conduct it.

What is Financial Forecasting and Budgeting?

- Use one of these balance sheet templates to summarize your company’s financial position at a given time.

- Budgeting serves as a baseline for comparison for actual results and expected performance metrics.

- Many factors beyond your control can potentially influence the market in ways you didn’t expect.

- Other analysts use prognoses to extrapolate how trends like the GNP or unemployment will change in the coming year.

- This modeling can help identify periods of cash shortfall and inform strategies for managing working capital effectively, ensuring the business can meet its obligations.

- Alternatively, firms can use qualitative methods, such as the Delphi method, to perform financial forecasting.

In most cases, the business in question here would consider other lower-level variables as well — potentially including customer-related information like total customers or retention rate. Consider enrolling in Financial Accounting—one of three courses comprising our Credential of Readiness (CORe) program—to learn how to use financial principles to inform business decisions. Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts. Financial results demonstrate business success to both shareholders and the public. Many factors beyond your control can potentially influence the market in ways you didn’t expect.

It focuses on using statistical methods to analyze economic data and test economic theories. Econometricians develop models that quantify relationships between economic variables, such as how changes in interest rates affect investment or how government spending impacts economic growth. Equity analysts use forecasting to predict how trends, such as gross domestic product (GDP) or unemployment, will change in the coming quarter or year. Statisticians employ forecasting to analyze the potential impact of a change in business operations. Analysts then derive earnings estimates that are often aggregated into a consensus number.

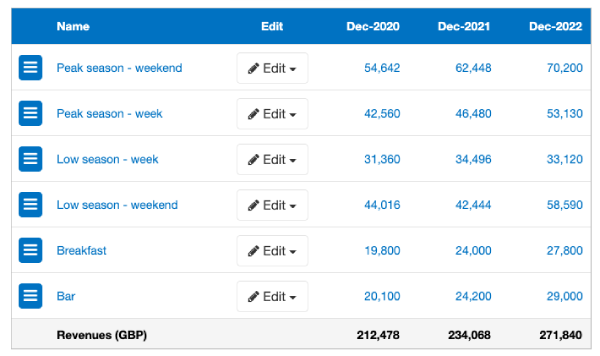

Small business owners and new entrepreneurs are the ideal users for this simple financial projection template. This template stands out due to its ease of use and focus on basic, straightforward financial planning, making it perfect for small-scale or early-stage businesses. Available with or without sample text, this tool offers clear financial oversight, better budget management, and informed decision-making regarding future business growth. Revenue forecasting estimates future sales based on historical data, market trends, and strategic initiatives.