A higher ratio indicates that the business is in a stronger position to repay its debt. Some of the popular ratios include debt coverage, interest coverage, asset coverage and cash coverage. As with other financial calculations, some industries operate with higher or lower amounts of debt, which affects this ratio. Specifically, the times interest earned ratio measures income before interest and taxes as a percentage of interest expense. Conversely, the cash coverage ratio measures cash against all current liabilities, not just interest expense. A coverage ratio is a financial ratio used to measure a company’s ability to repay financial obligations.

What is your risk tolerance?

The cash coverage ratio can be even more useful if tracked over time to determine trends. It is frequently used by lending institutions to determine whether a business is financially able to take on more debt. Suppose XYZ & Co. is seeking out a loan to build a new manufacturing plant. The lender needs to review the company’s financial statements to determine XYZ & Co.’s credit worthiness and ability to repay the loan. Properly evaluating this risk will help the bank determine appropriate loan terms for the project. For individuals, a high cash flow ratio is like having a nice buffer in a checking account to save after all monthly living expenses have been covered.

Current Cash Debt Coverage Ratio: Definition

- A poor interest coverage ratio, such as below one, means the company’s current earnings are insufficient to service its outstanding debt.

- By understanding both cash coverage ratio and TIE ratios, investors can better assess whether or not a potential investment is right for them based on their risk appetite and goals.

- It is similar to the interest coverage ratio, which examines whether companies can repay the interest expense.

- This measurement gives investors, creditors and other stakeholders a broad overview of the company’s operating efficiency.

- Many elements go into creating these financial ratios, and a deeper dig into a company’s financial accounts is typically necessary to determine a business’s health.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Instead of considering just one aspect of a year, it accounts for the entity’s past and future performance in terms of making debt payments. A leveraged buyout (LBO) is a transaction in which a company or business is acquired using a significant amount of borrowed money (leverage) to meet the cost of acquisition. Discover the key financial, operational, and strategic traits that make a company an ideal Leveraged Buyout (LBO) candidate in this comprehensive guide.

Understanding Coverage Ratios

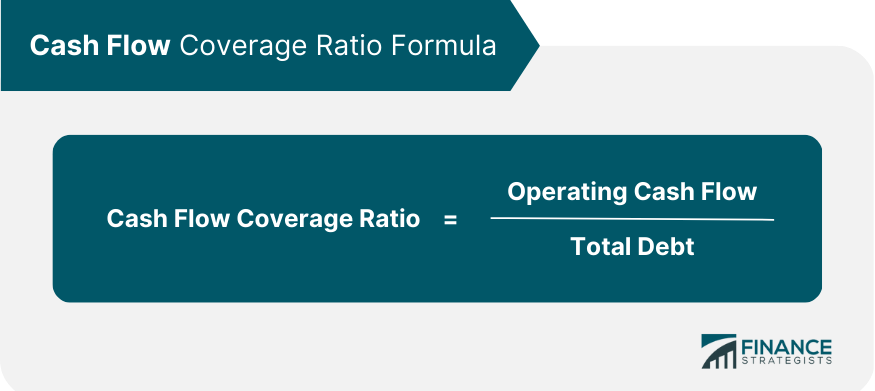

Investors, creditors, and corporate managers alike benefit from understanding and applying this ratio to make informed decisions. The CCR measures cash and equivalents as a percentage of current liabilities. However, the CDCR measures net cash from operations as a percentage of average current liabilities. Finally, the cash flow to debt ratio measures net cash from operations as a percentage of total debt. Coverage ratios allow stakeholders to measure a company’s ability to pay financial obligations.

FAR CPA Practice Questions: Calculating Interest Expense for Bonds Payable

Purposely, creditors leave out other sources of cash, such as accounts receivable and inventory. Clearly, the reason is that you can’t guarantee that you can convert these short-term assets to cash rapidly enough. Thus, cash is available for creditors without the delay of selling off inventory or collecting receivables.

Part 2: Your Current Nest Egg

Several coverage ratios look at how companies can cover those obligations. The ultimate purpose of a current cash debt coverage ratio involves identifying whether or not the company can cover its debt with the current operating cash flow generation. The xero shoes barefoot minimalist zero is a financial metric that evaluates a company’s ability to cover its interest expenses using its EBITDA.

If these non-cash items are substantial, be sure to include them in the calculation. Even though the company is generating a positive cash flow, it looks riskier from a debt perspective once debt-service coverage is taken into account. As a rule of thumb, utilities should have an asset coverage ratio of at least 1.5, and industrial companies should have an asset coverage ratio of at least two. A ratio of one or above is indicative that a company generates sufficient earnings to completely cover its debt obligations. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

In this example, Company Z has a cash coverage ratio of 5.83, which indicates that it has more than enough cash flow from its operating activities to cover its interest expenses. This suggests that Company Z is in a strong financial position to meet its debt obligations without relying on external financing. Net income, interest expenditure, debt outstanding, company’s cash balance, and total assets are just a few examples of financial statement components to scrutinize. To determine a firm’s financial health, look at liquidity and solvency ratios, which examine a company’s capacity to pay short-term debt and convert assets into cash. The Cash Coverage Ratio is an indispensable tool in financial analysis, offering insights into a company’s ability to meet its interest obligations through operational earnings.

Financial analysis is incomplete without understanding how companies handle their debt obligations. This ratio helps investors and analysts assess a company’s financial health, solvency, and its capacity to honor debt payments. Specifically, it gauges how easily a company comes up with the cash it needs to pay its current liabilities.

If the firm is not able to generate enough income to repay debt, then the assets of the company such as land, machinery, inventory, etc. can be sold off to give back the loan amount. The coverage ratio helps in tracking the debt situations of a company to help investors make wise investment decisions. If the same has been declining over the years, the investors know of the deteriorating financial state of the company. You can find the amounts of cash and cash equivalents held by an organization on its balance sheet. Banks look closely at this ratio to determine repayment risk when issuing a loan to a business.